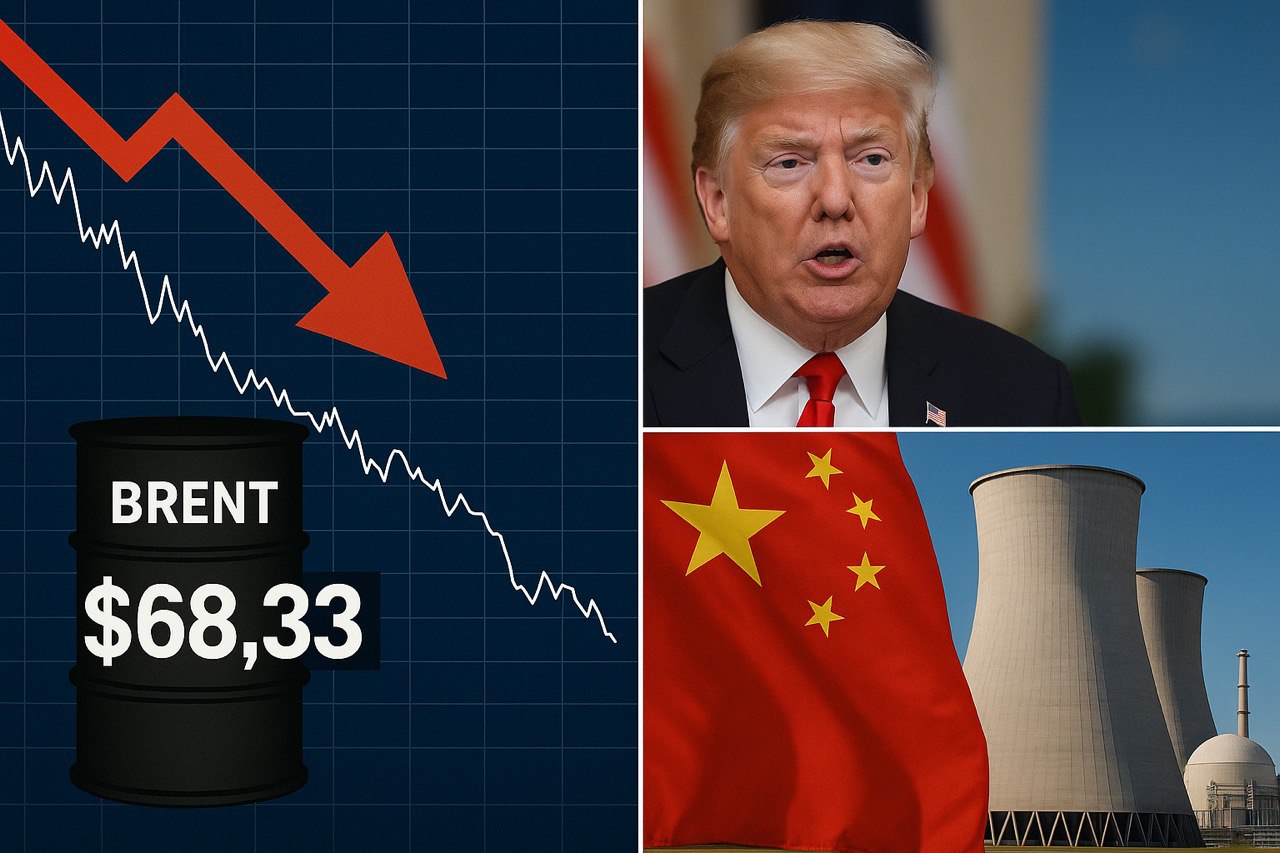

Brent crude has plummeted to around $61.90 per barrel as of May 2, 2025, a stark contrast to the $68.33 low since December 2021. It’s a vivid reminder of how interconnected global politics, economics, and technology can be, shaping the energy landscape in ways we’re still trying to understand. Let’s unpack what’s behind this drop and what it means for the future.

Current Oil Price and Historical Context

The price of Brent crude oil, a benchmark for global oil markets, has seen a notable decline. Recent data from Investing.com – Brent Crude Oil Price shows it at $61.90 per barrel, down from the $68.33 mentioned in earlier reports, which was already a low since December 2021. This downward trend isn’t just a fleeting moment; it’s part of a broader narrative influenced by supply, demand, and geopolitical shifts.

| Date | Price (USD/BBL) | Notes |

| Dec 2021 | ~68.33 | Lowest since this period |

| May 2, 2025 | 61.90 | Current price, significant drop |

This table highlights the trajectory, showing how prices have continued to fall, reflecting market pressures that we’ll explore next.

Factors Influencing the Price Drop

Several key elements are driving this decline, each with its own ripple effects.

Trump’s Tariff Policy: A Lingering Impact

Donald Trump’s tariff policies, known for their aggressive stance, have left a lasting mark. Even though his presidency ended in 2021, the economic uncertainties from those tariffs persist. Recent reports, like those from the U.S. Energy Information Administration (EIA), suggest new U.S. tariffs announced in early 2025 could further dampen global trade, reducing oil demand. It’s a bit like throwing a stone into a pond—the ripples keep spreading, affecting markets far and wide.

Increased Production Outside OPEC+

Another major factor is the surge in oil production from non-OPEC+ countries. According to TradingEconomics.com, Brent crude has decreased by 13.63 USD/BBL or 18.26% since the beginning of 2025, partly due to this increased supply. Countries outside the OPEC+ alliance, like the U.S. and Russia, have ramped up output, adding to an already oversupplied market. When there’s more oil than buyers, prices naturally take a hit—it’s basic economics, but with global stakes.

The Slowdown of the Chinese Economy

China, the world’s second-largest economy, is another critical piece of the puzzle. Its economic growth has slowed, and with it, its oil consumption. The EIA forecasts China’s GDP growth at 4.4% in 2025, down from previous years, which means less industrial activity and fewer vehicles on the road. This reduction in demand is a significant drag on global oil prices, especially given China’s role as a top importer.

China’s Rise in Nuclear Energy: A Potential Game Changer

Now, let’s shift gears to a development that could reshape the energy landscape long-term: China’s leadership in nuclear energy. According to the China Nuclear Energy Development Report 2025, China now has 102 nuclear reactors either operational, under construction, or approved, with a total capacity of 113 million kilowatts. This makes it the world leader, surpassing previous giants like the U.S. and France.

This shift is significant. Nuclear energy, being cleaner and more sustainable, could reduce China’s reliance on fossil fuels, including oil. If China continues this trajectory, it might import less oil in the future, adding further pressure on prices. It’s a bit like watching a chess game—each move changes the board, and this one could have lasting implications.

Advertisement Integration: A Tool for Navigating the Market

On a related note, I recently came across PocketOption, a trading platform that’s been gaining attention for its user-friendly interface and comprehensive tools for trading various assets, including commodities like oil. My colleague mentioned how it’s helped them navigate the volatile oil market with its real-time data and analysis features. If you’re interested in keeping tabs on oil prices or even trading, you might want to check it out at PocketOption.

Looking Ahead: What’s Next for Oil Prices?

So, where do we go from here? The current price of $61.90 is a far cry from its peaks, but is this the new normal, or just a temporary dip? Analysts, like those at Goldman Sachs, forecast Brent could trade in a range of $70-$85 per barrel, but with significant uncertainties. Factors like OPEC+ decisions, geopolitical tensions, and China’s economic recovery will all play a role.

One thing is clear: the oil market is at a crossroads, influenced by both traditional factors like supply and demand and newer elements like the shift towards renewable and nuclear energy. As we move forward, keeping an eye on these dynamics will be crucial for anyone interested in the energy sector.

Conclusion: A Thought-Provoking End

In conclusion, the drop in Brent crude oil prices to $61.90 per barrel is a complex phenomenon, driven by a mix of tariff policies, increased production outside OPEC+, and the slowdown of the Chinese economy. China’s emergence as a nuclear energy leader adds another layer, hinting at potential future shifts in global energy consumption. As always, the energy market remains unpredictable, but by understanding these factors, we can better navigate its twists and turns.

What are your thoughts on the current oil price situation? Do you think nuclear energy will play a significant role in reducing oil demand in the coming years? Share your insights in the comments below—I’d love to hear your perspective.