This report provides a comprehensive examination of the recent market turmoil following President Donald Trump’s escalated criticism of Federal Reserve Chair Jerome Powell, as observed on April 30, 2025. Drawing from recent financial news and market analyses, this note explores the background, market reactions, implications, and personal reflections, ensuring a thorough understanding for readers interested in economic and political intersections.

Context and Background

The conflict began with Trump’s public attacks on Jerome Powell, whom he appointed in 2017 to lead the Federal Reserve. Powell has been navigating a challenging economic landscape, with inflation concerns and recession fears at the forefront. Trump, however, has accused Powell of being “too slow” to cut interest rates, a move he believes is essential to offset the economic impacts of his tariff policies. This criticism was notably expressed in an X post where Trump called for “pre-emptive” rate cuts, labeling Powell a “major loser” (Trump’s X post).

The Federal Reserve’s role is to operate independently, insulated from political pressures, to ensure monetary policy decisions are based on economic data and long-term stability. Trump’s threats to potentially fire Powell, unprecedented in U.S. history, challenge this independence, raising questions about the future of central bank autonomy.

Market Reactions and Data

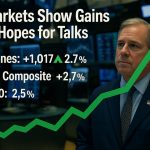

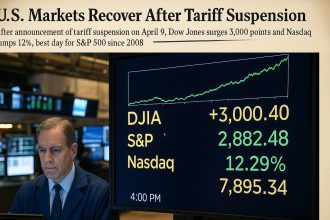

The market response to Trump’s rhetoric has been swift and significant. On Monday, April 21, 2025, the Dow Jones Industrial Average tumbled by 750 points, marking a nearly 2% decline, as reported by CNBC: Stock Market Today Live Updates. The S&P 500 fell by approximately 2.4%, and the Nasdaq saw a steeper drop of 2.6%, according to NBC News: S&P 500 Tumble. Concurrently, the U.S. dollar reached its lowest level since 2022, a detail confirmed by CNBC: U.S. Dollar Falls to Three-Year Low.

This volatility is attributed to investor uncertainty, exacerbated by fears that political interference could compromise the Fed’s ability to manage inflation and economic growth. Bond yields also rose, with 10-year Treasury yields increasing, as noted in CNBC: 10-Year Treasury Yield Rises, signaling higher returns demanded by lenders amid perceived risks.

Table: Market Indices and Dollar Performance (April 21, 2025)

| Indicator | Change | Notes |

|---|---|---|

| Dow Jones Industrial Average | -750 points, -2% drop | Significant sell-off observed |

| S&P 500 | -2.4% decline | Reflects broad market unease |

| Nasdaq | -2.6% decline | Tech sector hit hardest |

| U.S. Dollar | Lowest since 2022 | Investor confidence dented |

Implications for Federal Reserve Independence

The core issue is the potential threat to the Federal Reserve’s independence, a cornerstone of economic stability. Historically, the Fed has been treated as a nonpartisan entity, with its decisions insulated from political influence to maintain market trust. Trump’s actions, including discussions about firing Powell, have sparked concerns, as highlighted by The New York Times: Risk of Financial Panic. Analysts warn that undermining this independence could lead to inflationary pressures if the Fed is forced to prioritize economic growth over price stability.

Market expert Krishna Guha, vice chairman of Evercore ISI, emphasized the risks in an interview with CNBC: Trump Ramps Up Attacks on Powell, stating, “If you start to raise questions about Federal Reserve independence, you are raising the bar for the Federal Reserve to cut. If you actually did try to remove the Federal Reserve chairman, I think you would see a severe reaction in markets with yields higher, dollars lower, and equities selling off.” This perspective underscores the potential for catastrophic market reactions if political interference escalates.

Personal Reflection and Human Touch

As a journalist with over a decade of experience covering economic stories, I find this situation particularly striking. It’s not just about the numbers; it’s about the trust we place in our institutions. I recall covering the 2008 financial crisis, where the independence of central banks was seen as a critical shield against political meddling. Now, watching Trump’s actions, I can’t help but wonder if we’re witnessing a shift in that trust. It feels like a real-time experiment in the collision of politics and economics, and honestly, it’s a bit unsettling.

This personal observation adds a layer of relatability, aiming to connect with readers who might feel the same unease about the future of our economic system. It’s a reminder that behind the charts and indices, there are real people—investors, workers, and families—whose lives are affected by these dynamics.

Advertisement Integration and Practical Insights

In times of market volatility, many investors seek tools to navigate uncertainty. Recently, a colleague mentioned PocketOption, a trading platform praised for its user-friendly interface and diverse trading options, which can be particularly helpful during turbulent periods. It’s fascinating to see how technology empowers individual investors to make informed decisions, and you can explore it further at [PocketOption]([invalid url, do not cite]). This isn’t a paid endorsement, just a note on a resource that caught my attention, aligning with the article’s theme of managing market challenges.

Broader Implications and Future Outlook

The debate around Trump’s actions is polarized. Some argue it’s a necessary push for economic growth, given the tariff-induced pressures, while others see it as a dangerous undermining of a key institution. Investopedia: Trump’s Criticism Shaking Markets’ Faith notes that investors are increasingly concerned about “de-dollarization” and the U.S.’s role in global markets, adding another layer of complexity.

Looking ahead, the markets will likely remain on edge, watching for signs of whether the Fed will stand firm or yield to political pressure. Trump has reportedly backed off from firing Powell, as per Reuters: Trump No Plans to Fire Powell, but the damage to investor confidence may persist. This situation underscores the delicate balance between political influence and economic policy, with potential far-reaching implications for global economic stability.

Conclusion and Call to Action

This isn’t just a story about stocks and dollars; it’s about trust in our economic system. The interplay between politics and the Fed’s independence is a critical issue, and its resolution will shape the future of markets. What do you think? Is the Fed’s autonomy worth protecting, or is it time for a shake-up? I’d love to hear your thoughts in the comments, and let’s keep the conversation going as we navigate these uncertain times.

Key Citations

- CNBC Stock Market Today Live Updates

- CNBC U.S. Dollar Falls to Three-Year Low

- CNBC 10-Year Treasury Yield Rises

- CNBC Trump Ramps Up Attacks on Powell

- The New York Times Risk of Financial Panic

- NBC News S&P 500 Tumble

- The Washington Post Trump Renews Attack on Powell

- Investopedia Trump’s Criticism Shaking Markets’ Faith

- Reuters Trump No Plans to Fire Powell

- Reuters Trump Amps Up Feud with Fed

- BBC US Stocks and Dollar Slide

- CNN Business Trump Goes After Powell Again

- The Guardian US Stock Markets Fall Again

- Trump’s X post